A Closer Look at the Ongoing DeFi Vault Revolution

Andre

Posted on March 13, 2024

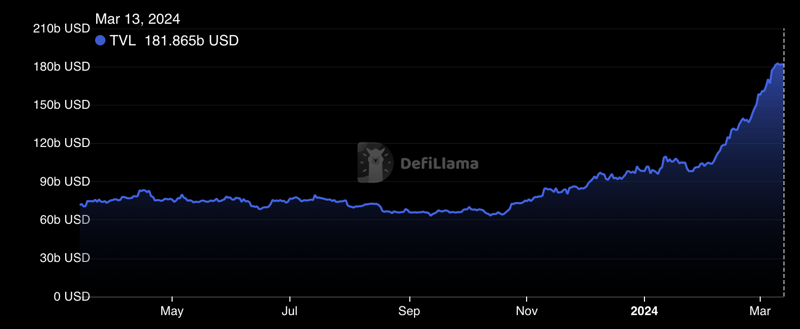

The decentralized finance (DeFi) ecosystem has expanded enormously over the last couple of years. This is best exhibited by the fact that despite being engulfed by a bear market over the vast majority of 2023, the sector’s total value locked (TVL) has grown from $70 billion to approx. $181 billion (as of Q1 2024), thus reflecting a growth of over 160%.

Amid this rise, the DeFi economy has borne witness to an increasingly innovative suite of solutions designed to optimize and structure various digital financial assets. A crucial aspect of this process has been the introduction of ‘vaults,’ marking a new era in DeFi development that has sought to unlock not only yield maximization opportunities but also simplify access to complex investment strategies for users.

An Introduction to the World of Digital Vaults

Straight off the bat, vaults can be viewed as automated investment tools that aggregate users' funds to optimize returns through strategic yield farming and other mechanisms. By pooling resources, they enable users, especially those with smaller portfolios, to participate in yield farming activities that would otherwise be prohibitive due to high transaction costs. Moreover, the automated management of these funds allows for the compounding of gains and maximization of returns on investments without the constant need for manual intervention by the users.

The essence of DeFi vaults lies in their ability to provide a hands-off investment experience while ensuring optimal capital utilization. This is achieved through smart contracts that automatically execute investment strategies, ranging from simple single-asset staking to complex, multi-layered strategies involving multiple protocols and transaction types — catering to a broad spectrum of investor risk appetites.

That being said, the significance of vaults extends well beyond the realm of ‘yield optimization’ alone. For instance, they also play a critical role in asset management, enabling a more structured and manageable approach to navigate this rapidly evolving sector while offering a compelling alternative to various traditional financial (TradFi) services, promising higher yields and more direct control over one's investments.

Modern Vaults Systems and Their Significance

Over the last year or so, DeFi vaults have evolved significantly, introducing sophisticated asset management solutions — each with their very own unique operational mechanisms and advantages —so as to cater to a wide array of investor needs.

Yield Farming Vaults

Yield farming vaults pool user funds to optimize returns on investments using automated strategies. They harvest farming rewards and reinvest them, compounding gains and allowing users, especially those with smaller portfolios, to maximize their returns without worrying about things like high gas fees. The complexity of these vaults can vary significantly — ranging from simple single-asset staking to advanced strategies involving multiple protocols — thereby catering to investors with different risk appetites.

Options Vaults

DeFi options vaults (DOVs) represent a significant innovation in structured financial products since they enable the scalable trading of non-linear instruments, such as options. As a result, they are able to overcome the challenges faced by TradFi systems in managing non-linear liquidations. By combining on-chain activities like investment and collateral management with off-chain risk management, DOVs provide a transparent and trustless solution for trading options.

These vaults fully collateralize option contracts, eliminating the need for liquidations and enabling tokenization and active trading of the contracts in a scalable manner. Lastly, DOVs not only enhance liquidity for altcoin options markets but also democratize access to sophisticated trading strategies previously available only to institutional investors or high net worth individuals.

Leveraged Yield Farming Vaults

Leveraged Yield Farming Vaults are advanced DeFi products allowing users to increase their exposure to yield farming opportunities through the use of borrowed funds. Essentially, these vaults amplify the potential returns (and risks) of yield farming by enabling participants to farm with more capital than they had initially contributed. By depositing assets into these vaults, users can borrow additional funds to invest in yield farming strategies, potentially increasing their profits significantly compared to traditional farming methods. However, the leveraged nature of these investments also means that risks are amplified such that if the market moves unfavorably, an individual’s losses can exceed their initial investment.

Decentralized Asset Management Vaults

The emergence of DeFi asset management protocols has introduced a new paradigm in wealth management, leveraging smart contracts to automate functions and reduce the inefficiencies inherent in the TradFi economy. These protocols offer a unified interface for investors to manage their assets, optimize earnings through automated strategies, and customize their investment approaches. Platforms like Yearn Finance and Beefy Finance have played pivotal roles in this evolution by automating yield generation and improving the user experience through the integration of innovative features like ‘zaps.’

Fixed Yield Vaults

As the name suggests, these financial instruments are designed to offer investors a predetermined return on their crypto deposits over a specific period — making them an attractive option for risk-averse investors or those looking for certainty in their investment returns. These vaults typically employ various strategies, such as lending assets to borrowers at fixed interest rates or investing in stable yield-generating protocols, to ensure the promised returns can be delivered.

Undercollateralized Lending Vaults

These offerings represent a significant shift from the overcollateralized lending practices typically found within DeFi. To elaborate, these vaults provide loans to borrowers without requiring them to lock up collateral worth more than the loan itself, a practice that increases capital efficiency and accessibility for borrowers. This is particularly impactful for small businesses or individuals who may not have sufficient crypto assets to meet overcollateralized loan requirements but are deemed creditworthy through alternative assessment methods.

Vaults: An Evolutionary Perspective

The evolution of vaults within the DeFi arena is a narrative that has been replete with innovation and transformation from day one, marking a shift from simple asset storage to complex financial instruments that can significantly impact the DeFi ecosystem. Here’s a brief rundown of how this space has continued to change over the years.

Yearn — A Pioneer in Yield Optimization

Yearn.finance has been a trailblazer when it comes to the evolution of vaults, introducing an innovative approach to yield farming. By automating the investment process, Yearn aggregates user deposits and allocates them to the most profitable DeFi strategies available, simplifying yield farming for users and maximizing their returns in the process.

MakerDAO — The Birth of Lending Vaults

MakerDAO's introduction of Maker Vaults in 2020 heralded a new era in decentralized lending and borrowing. By allowing users to deposit Ethereum-based assets as collateral, the protocol facilitates the generation of DAI, a stablecoin pegged to the U.S. dollar.

This mechanism maintains DAI's stability while showcasing MakerDAO's innovative approach to combining asset storage with financial utility. Lastly, the protocol's liquidation mechanism and the DAI Savings Rate (DSR) are designed to spur the DeFi ecosystem's overall growth and stability even further.

Compound Finance — Say Hello to ‘Automated Interest Yield’

Compound Finance has distinguished itself with a unique model that automates interest accrual on deposits through the issuance of cTokens. These tokens not only represent a user's stake in the platform’s native liquidity pool but also accumulate interest, allowing investors to earn yields on their assets in a secure and flexible manner.

As things stand today, DeFi vaults are more than just mechanisms for yield farming; they embody a comprehensive suite of financial services that offer liquidity provision, lending, borrowing, and risk management. Moreover, they have democratized access to complex financial strategies, enabling users from various backgrounds to engage with the DeFi space actively.

Rivo — The Rise of Yield Marketplaces

Since its launch, Rivo has stood out as a DeFi platform, aggregating a variety of investment strategies, including innovative vaults, to maximize yields for its users. For instance, the Venus USDT Core Pool on the Binance Smart Chain and BenQi's sAVAX lending on Avalanche showcase the platform’s commitment to offering diverse earning mechanisms. Moreover, Silo's novel approach to isolated lending pools and Yearn's trusted investment vaults exemplify Rivo's ability to integrate complex strategies into a user-friendly yield marketplace, making DeFi investments more accessible and efficient.

Where are DeFi Vaults Headed?

From the outside looking in, the future of DeFi vaults looks poised for significant growth and innovation, with several developments on the horizon promising to reshape this relatively nascent landscape completely. For instance, the integration of artificial intelligence (AI) is expected to enhance the efficiency and effectiveness of today’s existing vault strategies, while improved cross-chain interoperability stands to facilitate a seamless flow of assets across different blockchain networks, expanding the scope and reach of today’s DeFi services.

Furthermore, the development of more sophisticated risk assessment models can provide users with enhanced security and trust in these offerings, ensuring that investments are managed with the utmost precision. Thus, as these innovations come to fruition, DeFi vaults are set to become an even more integral part of the burgeoning DeFi ecosystem, offering users unprecedented opportunities for yield generation, asset management, and financial inclusion.

Posted on March 13, 2024

Join Our Newsletter. No Spam, Only the good stuff.

Sign up to receive the latest update from our blog.

Related

November 29, 2024